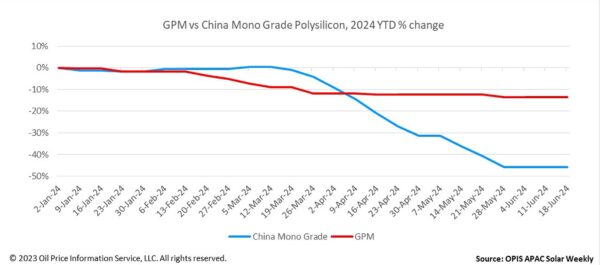

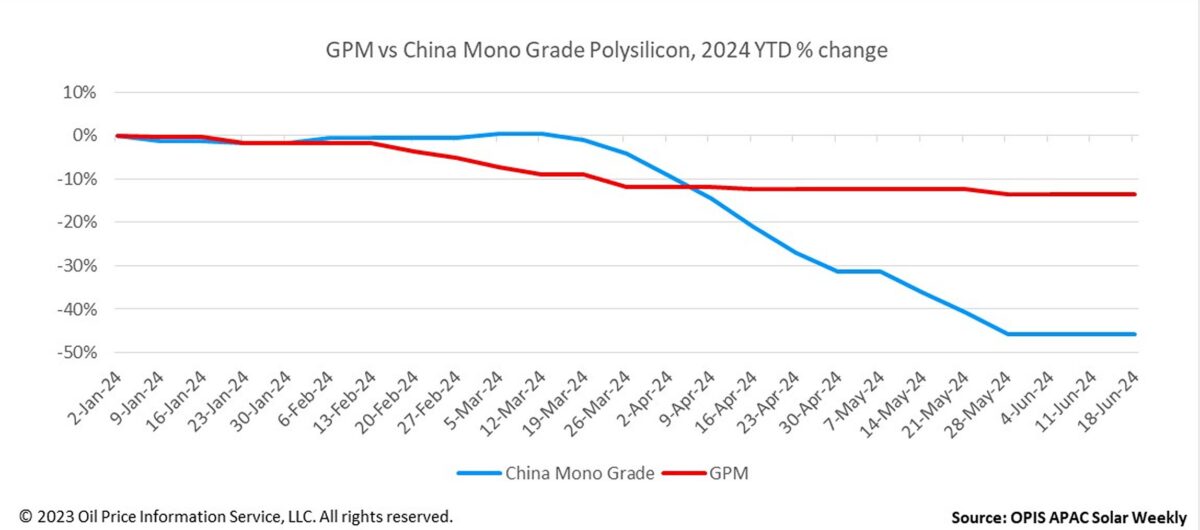

The Global Polysilicon Marker (GPM), the OPIS benchmark for polysilicon outside China, was assessed at $22.567/kg this week, unchanged from the previous week on the back of buy-sell indications heard. The price has held steady for four consecutive weeks.

According to a source knowledgeable about the polysilicon market outside of China, the trading status of global polysilicon in the spot markets is currently largely stagnant, with buyers awaiting the preliminary ruling from the U.S. anti-dumping and countervailing duties investigations expected in July.

A major global polysilicon buyer reported receiving spot prices from certain sellers lower than long-term agreement prices for the same specifications. However, due to uncertainty in US trade policy, they have refrained from placing an order.

This information was corroborated by a global polysilicon supplier, who expressed concern: “We are worried about inventory accumulation.”

Nevertheless, there are still optimistic voices lingering in the market, with sources reporting ongoing positive sales experiences. One of the sources explained that the solar supply chain features three distinct supply-demand relationships: between polysilicon and wafers, wafers and cells, and cells and modules.

“It’s argued that applying the current pessimism from the module market to the global polysilicon market is unjustified,” the source added. “Only the relationship between polysilicon and wafers directly influences the pricing of global polysilicon, which has been proven to be stable without notable fluctuations.”

China Mono Grade, OPIS’ assessment for polysilicon prices in the country, remained steady at CNY33 ($4.54)/kg this week, marking the fourth consecutive week of stability.

The market participants generally believe that current polysilicon prices do not need further reduction, as it would not significantly stimulate sales. Wafer companies are constrained by their operating rates and cash flow, limiting their ability to accelerate polysilicon procurement. “We are currently facing a loss of approximately 0.20 yuan for every piece of wafer produced,” a major wafer producer disclosed.

Multiple sources have confirmed that while nearly all Chinese polysilicon manufacturers are undergoing equipment maintenance, production cuts, or shutdowns, one major manufacturer is operating at full capacity with a 100% operating rate.

As a result, this company is incurring a monthly loss of CNY600-700 million in the polysilicon manufacturing segment, a source commented, noting that due to the factory’s large production capacity, operating at full capacity will keep overall polysilicon inventory levels high, casting uncertainty over the prospects for polysilicon prices.

Sources indicate that in addition to operating at full capacity, the company’s new production capacity is also ramping up as scheduled. This strategy underscores the company’s robust cash flow and its intent to leverage scaled capacity and cost advantages to squeeze the survival space of smaller companies in the ongoing price war.

According to an industry watcher, the current situation of selling polysilicon at a significant cash loss is unsustainable. By the end of the year, prices are expected to stabilize slightly above the average cash cost in the market, the source noted, who further anticipates that at that point, some excess production capacity, particularly high-cost or outdated facilities, will likely be phased out effectively.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.